san francisco sales tax rate breakdown

In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. The minimum combined 2022 sales tax rate for Contra Costa County California is.

Us Sales Tax On Orders Brightpearl Help Center

Some areas also have local sales tax rates on top of these charges.

. California 1 Utah 125 and Virginia 1. Since 1974 the San Francisco sales tax rate has increased eight times from 650 percent to the current rate of 850 percent. A City county and municipal rates vary.

All in all youll pay a sales tax of at least 725 in California. Type an address above and click Search to find the sales and use tax rate for that location. This tax does not all go to the state though.

Proposition 172 1993 extended the state sales tax rate of 6 percent which was set to decrease by one-half of a percent at the end of 1993. City of South San Francisco Sales Tax Measure W November 2015 San Mateo County. Our GIS-based sales tax website allows the user to view sales tax receipts from calendar.

This is the total of state and county sales tax rates. The California state sales tax rate is currently. A base sales and use tax rate of 725 percent is applied statewide.

The tax rate given here will reflect the current rate of tax for the address that you enter. State Local Sales Tax Rates As of January 1 2020. This is the total of state and county sales tax rates.

The 2018 United States Supreme Court decision in South Dakota v. The minimum sales tax in California is 725. Choose any state for more information including local and municiple sales tax rates is applicable.

6 rows The San Francisco County California sales tax is 850 consisting of 600 California state. Some 45 states plus the District of Columbia use state-wide base sales tax rates - while there are 5 states with no sales tax at state level. 5 digit Zip Code is required.

File Monthly Transient Occupancy Tax Return. The tax is collected by hotel operators and short-term rental hostssites and remitted to the City. Filing Requirements from the CA Franchise Tax Board.

The December 2020 total local sales tax rate was 9250. The true state sales tax in California is 6. Otherwise you will owe the annual tax rate of 884 and must file Form 100 California Franchise or Income Tax Return.

South San Francisco CA Sales Tax Rate. Sales tax region name. Presidio of Monterey Monterey 9250.

B Three states levy mandatory statewide local add-on sales taxes at the state level. Presidio San Francisco 8625. State Sales Tax Rates 1 View local sales taxes by state.

Since 1974 the San Francisco sales tax rate has increased eight times from 650 percent to the current rate of 850 percent. Please ensure the address information you input is the address you intended. What is the sales tax rate in Contra Costa County.

San Francisco California sales tax rate. The transient occupancy tax is also known as the hotel tax. Other than loan-related fees the big costs for buyers are for escrow fees and title insurance home inspections the first year of hazard insurance and property tax pro-rations if any.

4 rows 8625 tax breakdown. 5110 cents per gallon of regular gasoline 3890 cents per gallon of diesel. The Contra Costa County sales tax rate is.

For sellers closing costs usually run in the range of 6 to 7 of the sales price not including loan pay-off and any significant home preparation staging or. California Sales Tax. Those district tax rates range from 010 to 100.

4 rows Sales Tax Breakdown. The statewide tax rate is 725. The sales tax jurisdiction name is San Jose Hotel Business Improvement District Zone A which may refer to a local government division.

073 average effective rate. 5110 cents per gallon of regular gasoline 3890 cents per gallon of diesel. Consumers pay the combined state and local sales tax rate when they shop.

These rates are weighted by population to compute an average local tax rate. For state use tax rates see Use Tax By State. The total sales tax rate in any given location can be broken down into state county city.

The state then requires an additional sales tax of 125 to pay for county and city funds. The purpose of the Economy scorecard is to provide the public elected officials and City staff with a current snapshot of San Franciscos economy. 4 rows Sales Tax Breakdown.

The amount paid varies by locality. California requires S corporations to pay a 15 franchise tax on income with a minimum tax of 800. San Francisco imposes a 14 transient occupancy tax on the rental of accommodations for stays of less than 30 days.

California has a 6 sales tax and San Francisco County collects an additional 025 so the minimum sales tax rate in San Francisco County is 625 not including any city or special district taxes. Sales Tax Breakdown. This scorecard presents timely information on economy-wide employment indicators real estate and tourism.

San Francisco Tourism Improvement District.

Understanding California S Sales Tax

Sales Tax By State Is Saas Taxable Taxjar

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Understanding California S Sales Tax

Frequently Asked Questions City Of Redwood City

Sales Tax Collections City Performance Scorecards

California Sales Tax Rates By City County 2022

How Do State And Local Sales Taxes Work Tax Policy Center

California Sales Tax Rate By County R Bayarea

California City County Sales Use Tax Rates

Understanding California S Sales Tax

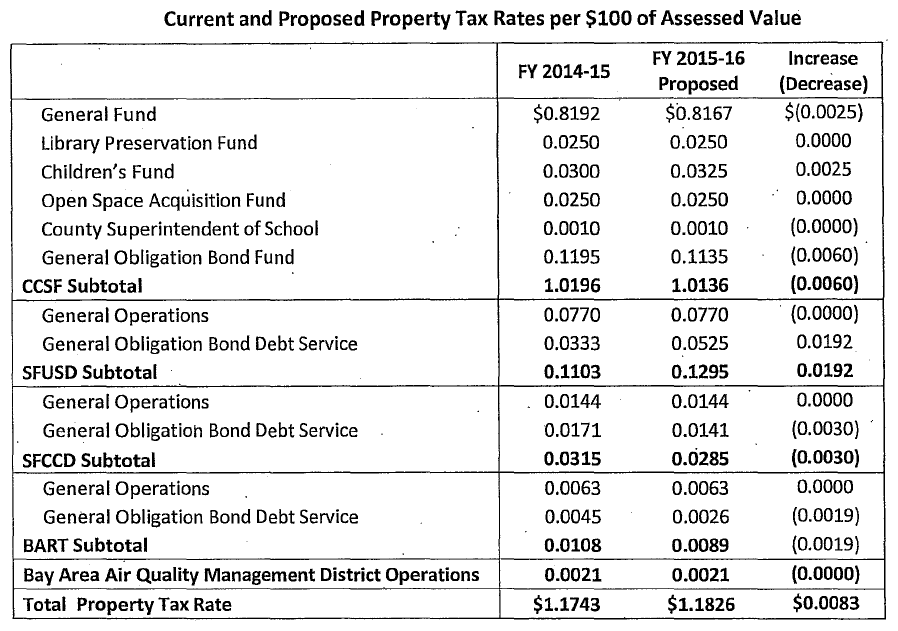

San Francisco Property Tax Rate To Rise Where The Dollars Will Go

Understanding California S Sales Tax

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

Understanding California S Sales Tax

How Do State And Local Sales Taxes Work Tax Policy Center

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur