capital gains tax increase news

According to a House Ways and Means Committee staffer taxpayers who earn more than 400000 single 425000 head of household or 450000 married joint will be subject to the highest federal tax rate beginning in 2022. NewsNow brings you the latest news from the worlds most trusted sources on Capital Gains Tax.

Taxation Capital Gains Tax Indirect Tax Types Of Taxes

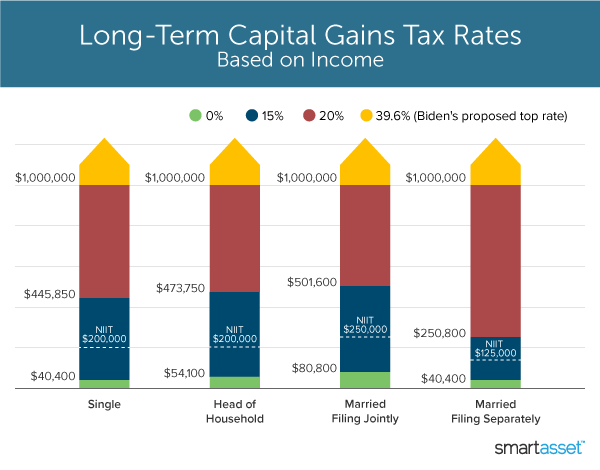

Above that amount you are now in the 15 ltcg tax bracket and pay 15.

. Capital Gains Tax Rate 2022 Capital gains tax would be increased to 288 percent according to House Democrats. The Biden Administration is proposing to nearly double US capital gains taxes to 396 per cent from the current rate of 20 per cent. But because the higher tax rate as proposed would only impact.

The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. That means you could pay up to 37 income tax depending on your federal income tax bracket. That takes out most taxpayers right there.

The Biden administration recently released plans to increase the top capital gains tax rate for people earning over a million dollars a year to. Relevance is automatically assessed so some. Under President Bidens proposal the highest tax rate for capital gains would increase to 396 up from a top rate of 20 currently.

In 1986 in anticipation of an increase in the tax rate to 28 percent in 1987 realizations of gains ballooned pushing tax revenue up to 529 billion. March 26 2022 229 PM PDT President Joe Biden will propose a minimum 20 tax rate that would hit both the income and unrealized capital gains of US. From 1987 to 1990 the capital gains tax.

NewsNow aims to be the worlds most accurate and comprehensive Capital Gains Tax news aggregator bringing you the latest headlines automatically and continuously 247. It seems pretty certain that the Federal long-term capital gains tax rate is going to increase from 15 percent this year to 20 percent in 2011. The changes only apply to tax year 2021.

See also Grammy Song Of The Year 2022 Nominees. Capital Gains Tax Rate Update for 2021 June 7 2021 The Biden administration has proposed an increase in the current favorable capital gain rates for people earning more than 1 million. So if youre pondering whether you should sell your.

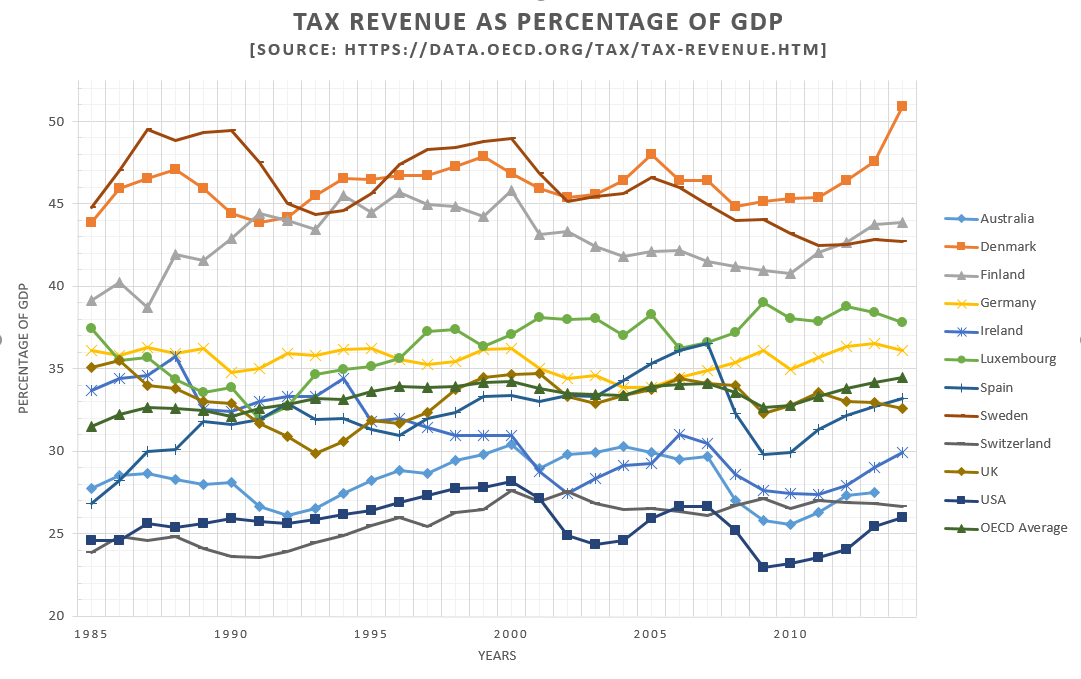

In the US short-term capital gains are taxed as ordinary income. 2 days agoOn top of both the expired Trump tax cuts and the Build Back Better taxes in the budget baseline that would give the United States the highest corporate income tax rate the highest capital gains tax rate and the highest top combined personal income tax rates among the 38 democracies in the Organization for Economic Cooperation and Development. President Biden is expected to announce a proposal to nearly double the capital gains tax rate in order to help fund a forthcoming spending package according to multiple reports.

Under President Bidens proposal the highest tax rate for capital gains would increase to 396 up from a top rate of 20 currently. Households worth more than 100 million as. For instance with the sale of a primary residence capital gains are levied on profits over 250000 for individual tax filers and 500000 for taxpayers filing joint returns according to the Internal Revenue Service.

Tax rates are 0 15 and 20. Capital gains tax The Democrat-led state Legislature approved a 7 tax. So A Big Capital Gain Can Push.

By Ken Berry JD. President Biden proposed increasing the capital gains tax and while that makes great headlines it probably isnt as big of deal as it sounds like. Capital Gains Tax News.

Tax filers can reduce or minimize their taxes with long-term capital gains. The 2021 legislative session was a busy one in Olympia with a handful of new laws set to take effect at the start of 2022. The rate could be as high as 396 matching the top ordinary income tax rate before the Tax Cuts and Jobs Act TCJA.

First off the higher tax would only apply to those with income above 1 million. Yes this is much lower than your typical income tax rate. Biden proposes nearly doubling the long-term capital gains tax rate for households with more than 1 million in income from its current 20 percent to 396 percent the same rate that they would pay under his plan on wages earned from working.

But because the higher tax rate as proposed would only impact. 2021 Federal Income Tax Brackets. Capital gains have marginal rates for different income brackets which begin at 0 then climb to 15 then up to 20.

Pin By Correctdesign On Menu Iphone App Samples Tax Table Capital Gains Tax Accounting

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Capital Gains Accounting Education Accounting And Finance Financial Management

The Ultimate Australia Crypto Tax Guide 2022 Koinly

Any Gain That Arises From The Sale Of A Capital Asset Is A Capital Gain This Gain Or Profit Is Comes Under Th Capital Gains Tax Capital Gain Financial Peace

Tax On Property Transaction Below Circle Rate Sec 50c Sec 56

Pin By Nawaponrath Asavathanachart On 1945 Capital Gains Tax Germany And Italy Capital Gain

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Irs Tax Brackets 2022 What Are The Capital Gains Tax Rate Thresholds Marca

Taxation In Australia Wikipedia

How Does The Personal Representative Deal With The Income And Capital Gains Arising After The Deceased S Death Low Incomes Tax Reform Group

The Ultimate Australia Crypto Tax Guide 2022 Koinly

Options Trading Taxes For All Traders Option Trading Futures Contract Capital Gains Tax

Capital Gains Definition 2021 Tax Rates And Examples

What S In Biden S Capital Gains Tax Plan Smartasset

Capital Gain Or Appreciation Increase In Value Of Assets Currency Market Capital Gain Participation Rate

Top 10 Federal Tax Charts Capital Gains Tax Tax Day Tax Rate

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay